step 1. The new $25,000 Down-payment To the Guarantee System Expected during the 2022

An average You.S. household buyer uses payday loan Brilliant seven decades rescuing to possess a downpayment. That’s a long time to go to to invest in property specifically while the life gets more costly and you will rents go up per year.

When you’re ready to acquire, just be capable pick. Unique apps readily available for very first-time buyers plus first-day family customer grants makes it possible to reach your American Dream at some point.

- → What’s an initial-Time Domestic Buyer Offer?

- → What exactly are Particular Earliest-Date House Client Grants?

- → What’s an initial-Day House Visitors System?

- → What are the Different varieties of Very first-Time Household Buyer Programs?

- → Frequently asked questions in the Speak

An initial-big date house visitors give try a particular grant particular designed to perform the brand new homeowners all over the country. Governing bodies honor features into the regional, condition, and you may government top; and you can charitable and you may casing fundamentals across the country.

Offers do not require repayment because the grant recipient works a public an excellent. To possess earliest-big date home buyers, that public a good is homeownership.

- Stabilize communities of the many molds

- Boost prosperity contained in this all teams

- Generate generational wealth within families

Based on bodies research, $10,000 offers to help you basic-date homebuyers increases homeownership of the 34 percent, so it is no surprise one to Congress has just brought seven bills producing provides and you can income tax credit to have basic-big date homebuyers, like the Lift Act.

In 2021, Congress lead an expenses entitled The newest Advance payment For the Guarantee Operate, a home visitors offer for very first-age group home buyers that have more grant currency available to renters that have socially or economically disadvantaged experiences.

The brand new Advance payment To your Security Work prizes up to $25,one hundred thousand very clients can buy its basic domestic. Give monies are often used to build an advance payment, buy closing costs, decrease your home loan price that with dismiss issues, and security other costs, as well.

2. Federal Homeowners Fund

The brand new National Homebuyers Funds are a non-earnings societal work for enterprise. It sponsors earliest-some time recite homebuyers with as much as 5 % out-of a good residence’s cost.

First-big date people are able to use the application form that have a traditional, FHA, Va, otherwise USDA financing, also it forgives the borrowed funds five years immediately after closing. Renters are unable to get the brand new National Homebuyers Financing give directly simply your mortgage lender can do it. Label (916) 444-2615 discover a summary of using loan providers.

step three. Condition and you may Local government Grants

Certain county and you may regional governments mentor housing provides getting qualified basic-go out consumers. Offer designs start from the $500. Funds enforce with the settlement costs, home loan price avoidance, or a down payment.

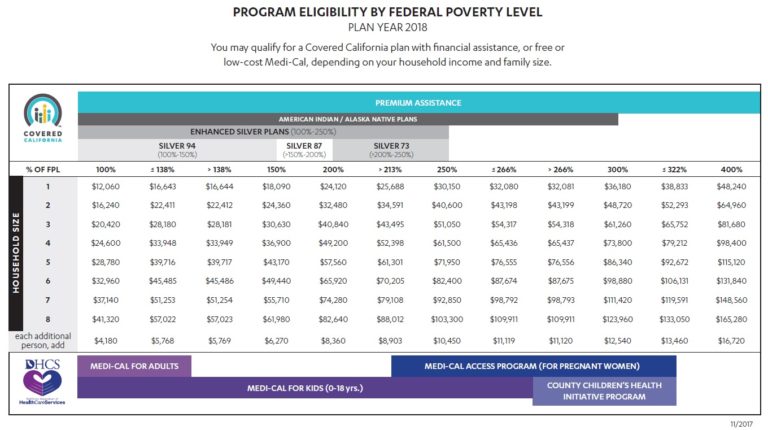

Many local casing offers need buyers to generally meet minimum credit standards and you can secure children earnings inside a certain, lower-income variety.

So you can qualify for a state otherwise regional housing grant, pick your own municipality’s societal-up against web site, identify housing recommendations otherwise housing grants, and you can remark neighborhood program criteria.

4. Brand new Homebuyer Forgivable Financial

The brand new Homebuyer forgivable financial is home financing that acts for example a great housing offer. Approved consumers receive cash having an advance payment all the way to 5% of their purchase price with no appeal charged and you may payment expected.

Few are eligible for the new Homebuyer forgivable home loan. At least, recipients should have average credit scores, be eligible for an enthusiastic FHA mortgage, and you may invest in undertake a thirty-season fixed-speed mortgage. Consumers may also be necessary to attend a 1-hour on the internet academic seminar.

First-day home buyers apps are made to help individuals with no time before owned her home. Similar to earliest-date family visitors has, such software generally come from federal, county, or local governing bodies. You can find her or him due to the fact advance payment direction, forgivable mortgages, settlement costs, or tax loans.