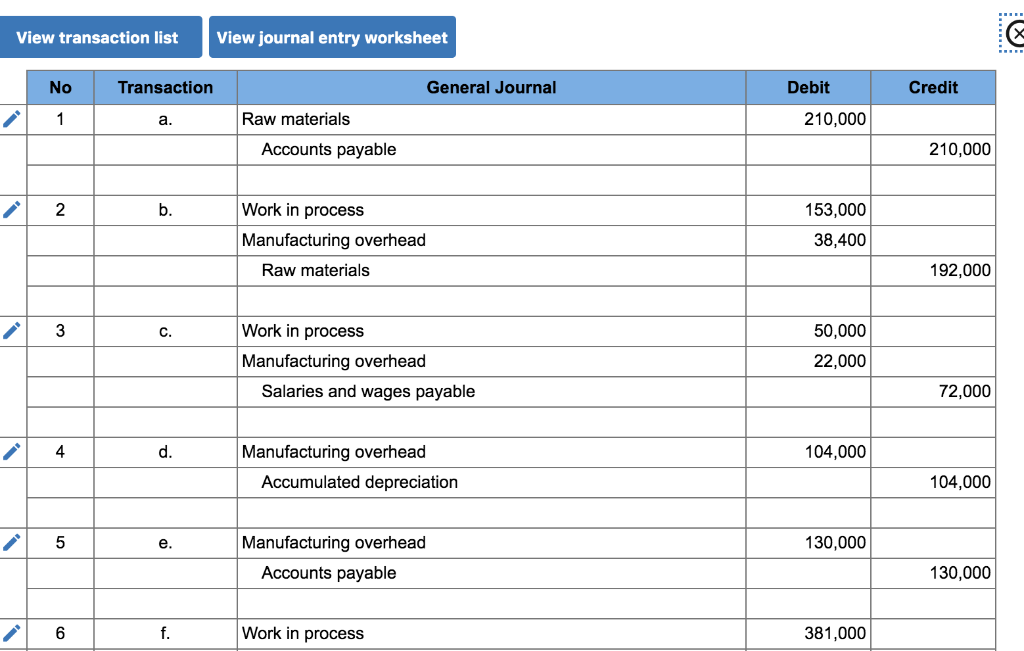

Journal Entry for Job Order Costing Example

The transactions are to be recorded for six jobs in production in August, Roberts’ first month of operations. The business applies overhead to the jobs on the basis of total direct labor cost. Examples includehome builders who design specific houses for each customer andaccumulate the costs separately for each job, and caterers whoaccumulate the costs of each banquet separately. Consulting, law,and public accounting firms use job costing to measure the costs ofserving each client. Motion pictures, printing, and otherindustries where unique jobs are produced use job costing.Hospitals also use job costing to determine the cost of eachpatient’s care. For example, in January, we used a total of $200,000 raw materials in production.

Video Illustration 2-3: Applying manufacturing overhead to jobs LO4

And these $200,000 raw materials include $20,000 indirect raw materials that cannot be traced to specific jobs. Non-manufacturing labor costs, such educator expense deduction as office or administrative wages, are period costs. Non-manufacturing labor costs are debited to an expense account for wages or salaries.

1 Job Order v. Process Costing

The diagram in Figure 8.1 shows a partial organizational chart for sign manufacturer Dinosaur Vinyl. The CEO has several direct reporting units—Financing, Production, Information Technology, Marketing, Human Resources, and Maintenance—each with a director responsible for several departments. A job cost system (job costing) accumulates costs incurred according to the individual jobs. Companies generally use job cost systems when they can identify separate products or when they produce goods to meet a customer’s particular needs. During this two-month period, one customer sent in an identical order each month, calling for the production of 1,000 units.

Manufacturing overhead

Production used $13,500 of direct material and worked 21 direct labor hours at a rate of $20 per hour. An organization-wide, or organizational, predetermined manufacturing overhead rate is computed by dividing the total estimated manufacturing overhead amount by the total estimated allocation base or cost driver. Total estimated overhead includes all product costs and is commonly separated into fixed manufacturing overhead and variable manufacturing overhead.

This required 400 direct labor hours at $1 per hour and materials amounting to $750. For example, we estimate the annual overhead cost and the annual direct labor cost to be $600,000 and $800,000 respectively for the period. And we have a total of $90,000 direct labor cost that occurred in January. This is because we usually need to make the journal entry for job order costing on a monthly basis. However, not all the cost information that is related to the manufacturing overhead is available on a monthly basis. Even if several jobs are started at once, it does not necessarily mean that they will all be completed at the same time.

Period costs are deducted from gross profit to arrive at net operating income, also referred to as net profit. In a journal entry, we will do entries for each letter labeled in the chart — where the arrow is pointing TO is our debit and where the arrow is coming FROM is our credit. Here is a video discussion of job cost journal entries and then we will do an example. Many companies use costing systems that are a blend of features of both job-order costing and process costing systems. Job order costing is a cost accounting system in which direct costs are traced and indirect costs are allocated to unique and distinct jobs instead of departments. It is appropriate for businesses that provide non-uniform customized products and services.

It should be noted that job costing and process costing are two different methods of costing. The overhead is then applied at this rate to each job based on its direct labor cost. The totals of all transfers in and out of the job cost sheets in the WIP ledger are also posted to the WIP control account in the general ledger. At the end of an accounting period the balance on the WIP control account should equal the sum of the balances on each of the job cost sheets in the WIP ledger. In a journal entry, we will do entries for eachletter labeled in the chart — where the arrow is pointing TO is ourdebit and where the arrow is coming FROM is our credit.

No matter who the customer is, they all end up receiving the same product. The nature of their work is such that they are interested in finding profitability of different jobs and hence they accumulate costs with reference to different jobs like audit engagement, consulting projects, books, movies, etc. Costs are transferred to the work in process account using the following accounting source documents.

He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. The company should use predetermined FOH rates for correct calculations and control.

- The accounting emphasis is in keeping records for the individual departments, which is useful for large batches or runs.

- Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

- When manufacturing overhead is applied to the jobs in process, it is credited from the Manufacturing Overhead account and debited to the Work In Process account.

- DS purchased raw materials (such as aluminum, fiber, etc.) at a cost of $4 million.

- Manufacturing overhead is applied based on labor hours in the fabrication department and machine hours in the finishing department.

Work in Process (WIP) is the inventory account where product costs including direct material, direct labor, and manufacturing overhead are accumulated while the jobs are in the manufacturing process. Work in Process (WIP) is the inventory account where product costs–direct material, direct labor, and manufacturing overhead–are accumulated while the jobs are in the manufacturing process. This means that the company would estimate $6 in manufacturing overhead costs for every one machine hour worked ($450,000 divided by 75,000 machine hours).