#dos. Bad credit Financing: Online Financing Lending Enterprises For Worst Otherwise Poor credit Rating

This feature support new registered users avoid any college student errors if this pertains to paying and you can spending. They also have informative resources that lay him or her except that one race about on the web credit field.

While the MoneyMutual has actually a wide variety of lenders, each also provides other APRs and you can interest rates. Yet not, the lenders charge a competitive price and do not require so many costs.

This new Annual percentage rate and you will interest rates offered is aggressive so you can ount recharged isnt offered as it is determined by different aspects such as for example the lender, loan amount, borrower’s problem, and the like.

MoneyMutual is very discover and you can transparent throughout the its team practices. Its user-amicable web site provides intricate analysis and information regarding the company’s operations. As well, they also have buyers product reviews, Faqs, and you can instructional resources. Profiles may fill out one issues otherwise hop out treatments towards website site.

Customers Reviews

Customers like MoneyMutual due to just how easy they generate the mortgage techniques, the competitive costs they fees, plus the customer service they offer after a loan. At exactly the same time, profiles enjoy immediate loans dumps as most users look for crappy borrowing loans inside problems.

Experts

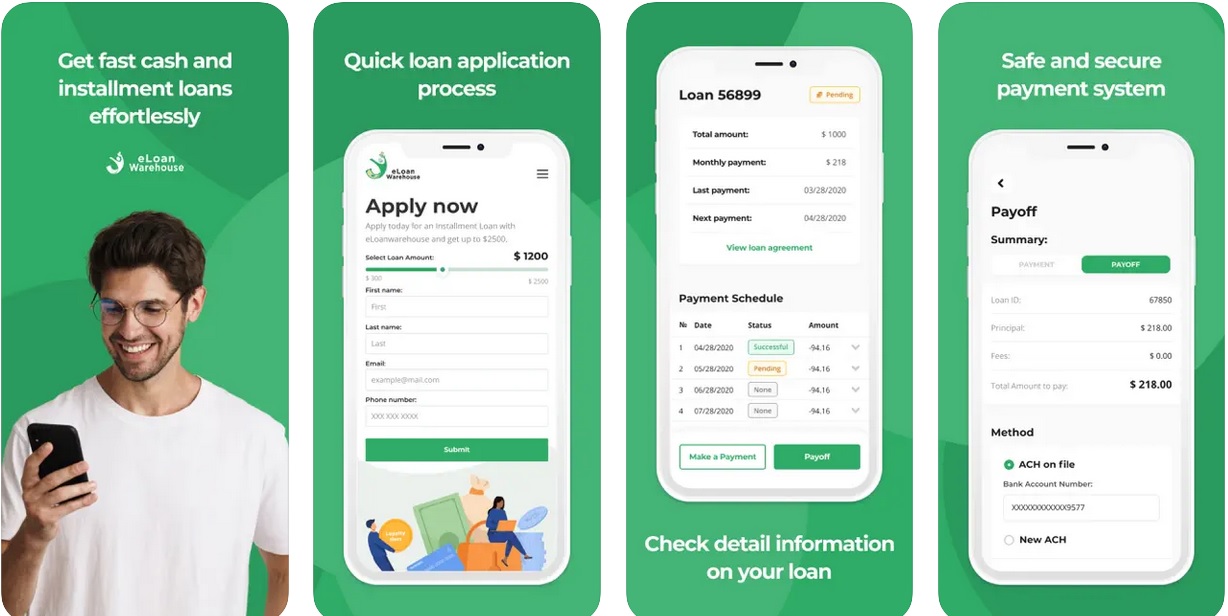

- Quick and simple approval techniques

- Web site is easy to utilize and you may browse

- Borrowers is get the funds within this lower than twenty four hours from acceptance

- Higher lending network

- Encrypted and safe website

- Services offered is without charge

Cons

- Merely U.S. customers can get that loan

- Not available in the Nyc otherwise Connecticut

Review

Next, towards the list was Poor credit Financing, other program one facilitates connections within consumers and you can lenders. Established in 1999, it system could have been helping individuals get less than perfect credit money having guaranteed approvals for a long period.

Less than perfect credit Fund provides your back secured whether or not you prefer let in financial trouble integration, credit card debt relief, book, credit card refinancing, book, auto fixes, scientific, vacation, otherwise one emergencies.

New platform’s credit community can help you generate a great financing conclusion, and you may users elitecashadvance.com loan places open on sunday near me is less than no obligation to accept a deal it hate. Such as for instance MoneyMutual, the organization along with works together with third-party lenders exactly who expose their particular terms and conditions.

Users is also request a loan anywhere between as low as $five hundred to help you as huge as $ten,100000. On top of that, Bad credit Fund has the benefit of versatile percentage choice and provide profiles new independence to settle the mortgage inside to 3 years. But not, the speed can vary with regards to the small print of your own bank. Always, the eye pricing can range out of 5.99% to help you % Apr.

In order to be eligible for a bad credit financing, profiles need to be older than 18, has actually a reliable revenue stream, and feature evidence of U.S. citizenship. This is simply the fundamental app requirements off Poor credit Funds, and the 3rd-people lender including sets further qualifications requirements.

To try to get financing, pages simply have to follow three simple actions, therefore the currency will be transferred to its savings account in less than twenty four hours. But, earliest, they have to fill out an easy function available on their certified webpages.

Throughout the software, you’re going to have to put in the details of the newest fund including the cause for the brand new financing, the total amount need, promote proof of citizenship, offer private information, and many monetary information. After that, what you need to perform is actually hold off due to the fact organization do the rest of the performs.

Bad credit Fund connects one to reliable lenders who are chose from the guidance your bring. The lender encounters your application while offering a quick payday loan which have conditions and terms centered on your preferences. If you like the offer, you could indication the fresh package; otherize, there’s always the option to help you decline it. There isn’t any for the last just like the give try recognized, thus constantly investigate small print carefully.