Reconcile an account in QuickBooks Online

Verifying the reconciliation results gives you peace of mind that your credit card accounts in QuickBooks Online are accurate and in line with your credit card statements. It allows you to confidently use QuickBooks Online for financial reporting, making informed business decisions based on accurate and reliable data. By performing regular reconciliations, you can identify any discrepancies or errors promptly, helping to prevent any potential issues or misunderstandings with your finances.

What To Do if Credit Card Transactions Don’t Match QuickBooks Entries

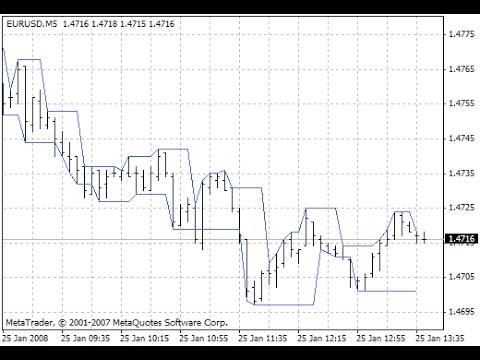

For every transaction that matches your statement, click on the checkbox next to the transaction. As you put a checkmark on a transaction, you’ll notice that the cleared balance and difference on the lower right side of the screen adjust. Here’s a sample reconciliation with all of the transactions matched to a credit card statement.

- QuickBooks won’t create a bill so your credit card balance isn’t affected.

- To do this, right-click on the reconciliation screen’s tab in your internet browser and select “duplicate” to open a second tab.

- We prefer and recommend using the Accountant View because it shows a full range of business accounting features and tools that you can use in QuickBooks.

- If you have finance charges on your credit card statement that are not listed in QuickBooks Online, then you need to add them manually.

- You’ll know you reconciled your credit card balance successfully when the difference between your statement ending balance and cleared balance is zero.

How To Unmatch A Transaction In Quickbooks Online

Reconciling credit cards in QuickBooks Online is an essential task for maintaining accurate and up-to-date financial records. By following the step-by-step process outlined in this guide, you can ensure that your credit card transactions in QuickBooks Online align with your credit card statements. Matching your credit card transactions with your credit card statement helps reconcile the two and ensures your financial records in QuickBooks Online are accurate and up-to-date. You may encounter discrepancies during this process, such as missing or mismatched transactions. Make note of any discrepancies for further investigation and resolution.

If you don’t want to execute either of the two actions, click Cancel, and you’re done. After completing the previous step, QuickBooks will display a screen with a summary of the reconciliation in the top half and detailed transactions in the bottom half. If your sidebar menu is not what is shown in our tutorial, it means that you are on Business View. We prefer and recommend using the Accountant View because it shows a full range of business accounting features and tools that you can use in QuickBooks.

How To Reconcile Credit Card Accounts in QuickBooks Online

If you forgot to enter an opening balance in QuickBooks in the past, don’t worry. I’ll be around if there’s anything that I can help with your reconciliation.

We’ll teach you how to trace transactions from QuickBooks to your credit card statement and vice versa. Navigate to the Reconcile tab under Accounting, select the appropriate credit card account, and enter the statement date and ending balance from your credit card statement. Then, match the transactions in your statement to those in QuickBooks. Just like balancing your checkbook, you need to review your accounts in QuickBooks to make sure they match your bank and credit card statements. Remember, staying on top of your credit card reconciliations is crucial for effective financial management.

After entering all your statement information, click the green Start reconciling button. Once you verify that you are on Business View, click on Switch to Accountant view to update the appearance of your sidebar menu. In a the quality of receivables refers to few seconds, you should see the same left-side menu bar illustrated in this tutorial. However, if you see existing transactions recorded in QuickBooks manually that are identical to the downloaded ones, link them together to avoid getting duplicates. I’d recommend consulting an accountant to guide you with the process. After entering all information, click the Continue button at the bottom of the screen.

How To Add A Bank Account In Quickbooks

When you’re finished setting up your payment or have decided to wait until later, hit the green Done button (not shown in the image above). Changes can unbalance your accounts and other reconciliations. It also affects the beginning balance of your next reconciliation. Thanks for sharing the detailed process you’ve done during the reconciliation. I have very limited accounting skills so if possible please provide detailed instructions.

How To Reconcile Credit Card Accounts in QuickBooks Online

If you aren’t a QuickBooks Desktop user yet, you can choose from a Pro, Premier, Enterprise, or Accountant package. We compare QuickBooks Desktop products to help you decide which one is right for you. If you decide to purchase Pro, one of our best small business accounting software, you will get a 33% discount on your first year. I wanted to see how everything about fixing your credit card reconciliation. QuickBooks won’t create a bill so your credit card balance isn’t affected. After you click Reconcile Now, a pop-up screen will appear asking whether you want to write a check for payment now or enter a bill to pay later.

How To Record Credit Card Payments In Quickbooks Online

- Let’s dive into the step-by-step process of reconciling your credit cards in QuickBooks Online.

- If you see a transaction in QuickBooks that isn’t on your credit card statement, don’t delete it.

- In our sample credit card statement, you’ll notice that the transaction for Michael Kretchmar for the amount of $300 isn’t recorded in QuickBooks.

It needs to match the balance of your real-life bank account for the day you decided to start tracking transactions in QuickBooks. With the reconciliation results verified, you have successfully completed the process of reconciling your credit cards in QuickBooks Online. Let’s dive into the step-by-step process of reconciling your credit cards in QuickBooks Online.

Once added, mark the transaction as cleared by clicking the radial button in the right-most column. You need to investigate any transaction in QuickBooks that isn’t on your bank statement. While the most likely cause is an error in your QuickBooks accounting, don’t delete the transaction because it may affect other accounts or periods.

The Quality Assurance Process: The Roles And Responsibilities

If it isn’t, then you can head to our guide on how to process bank reconciliation in QuickBooks Online, which covers some troubleshooting tips to help you locate discrepancies. When you have your bank statement in hand, you’ll compare each transaction with the ones entered into QuickBooks. If everything matches, you know your accounts are balanced and accurate.

You should enter a bill because doing so moves a portion of your credit card liability to a current accounts payable (A/P). The advantage is that your credit card payment and due date now appear with your other A/P, so you have a reminder to pay the bill before it becomes overdue. When your reconciliation is complete, click the green Finish now button in the upper-right corner of the screen. Since all adjusting entry for bad debts expense of your transaction info comes directly from your bank, reconciling should be a breeze. Yes, as the statement serves as a reference to compare with the transactions in QuickBooks.

You can see that the difference is zero, which means that the statement ending balance and cleared balance also matches. By diligently following these steps, you can reduce the risk of errors, identify discrepancies, and maintain a clear and accurate picture of your company’s financial health. Regularly reconciling your credit card accounts will also help you identify any potential issues with your finances, enabling you to take the necessary steps to address them swiftly.

All you need to do is to review, categorize, and approve them from the For Review section. Mark Calatrava is an accounting expert for Fit Small Business. As a QuickBooks ProAdvisor, Mark has extensive knowledge of QuickBooks products, allowing him to create valuable content that educates businesses on maximizing the benefits of the software. When tracing from QuickBooks to your statement, you placed a mark next to each transaction on your statement that was shown in QuickBooks. Now, look for any transactions on your statement that don’t have a mark. If unmarked transactions are legitimate, they need to be added to QuickBooks.

AI Writing: How It’s Changing the Way We Create Content

Good morning and thank you for the quick response, I have been using QB desktop for 20+ years and QBO has got me confused. The CC charges are listed in the bank transactions however they do not appear in the reconciliation when I start the reconciliation. Thank you for choosing QuickBooks Online (QBO) as your accounting tool, Rocco.

Ensure that all the details—including the dates, amounts, and descriptions—match your credit card statement. QuickBooks will display a message to confirm the reconciliation is complete and to ask if you want to make a payment towards this credit card balance. Feel free to let me know if you need further assistance with reconciling your credit card transactions. Once you connect your account, you don’t need to enter each transaction manually. Your bank entries will be downloaded to QuickBooks automatically.

Depreciation: Definition and Types, With Calculation Examples

MACRS calculations tend to be a more complicated method for calculating depreciation and may benefit from the support of a tax professional. If an asset is depreciated for financial reporting purposes, it’s considered a non-cash charge because it doesn’t represent an actual cash outflow. While the entire cash outlay might be paid initially—at the time an asset is purchased—the expense is recorded incrementally (to reflect that an asset provides a benefit to a company over an extended period of time). And, the depreciation charges still reduce a company’s earnings, which is helpful for tax purposes. Sum-of-years-digits is a spent depreciation method that results in a more accelerated write-off than the straight-line method, and typically also more accelerated than the declining balance method. Under this method, the annual depreciation is determined by multiplying the depreciable cost by a schedule of fractions.

We and our partners process data to provide:

You’ll usually record annual depreciation so you can measure how much to claim in a given year, as well as accumulated depreciation so you can measure the total change in value of the asset to date. The total amount depreciated each year, which is represented as a percentage, is called the depreciation rate. For example, if a company has $100,000 in total depreciation over an asset’s expected life, and the annual depreciation is $15,000, the depreciation rate would be 15% per year. There are several different depreciation methods, including straight-line depreciation and accelerated depreciation. In determining the net income (profits) from an activity, the receipts from the activity must be reduced by appropriate costs. Depreciation is any method of allocating such net cost to those periods in which the organization is expected to benefit from the use of the asset.

Diminishing balance method

Therefore, after a certain period, the value of the exhausted asset will be zero. Due to the continuous extraction of minerals or oil, a point comes when the mine or well is completely exhausted—nothing is left. The decisions that are made about how much depreciation to charge off are influenced by the accountant’s judgment. Learn more about the benefits of claiming depreciation and depreciation examples with frequently asked questions about depreciation. Number of units consumed is the amount that you used in a given year—in this case, perhaps your machine produced 30,000 products, so you would have used 30,000 units.

Part 2: Your Current Nest Egg

When a company buys an asset, it records the transaction on its balance sheet as a debit (this increases the asset account on the balance sheet) and a credit; this reduces cash (or increases accounts payable) on its balance sheet. Neither of these entries affects the income statement, where revenues and expenses are reported. Some systems specify lives based on classes of property defined by the tax authority. Canada Revenue Agency specifies numerous classes based on the type of property and how it is used. Under the United States depreciation system, the Internal Revenue Service publishes a detailed guide which includes a table of asset lives and the applicable conventions. The table also incorporates specified lives for certain commonly used assets (e.g., office furniture, computers, automobiles) which override the business use lives.

Double-Declining Balance Depreciation

- Both of these can make the company appear „better“ with larger earnings and a stronger balance sheet.

- Finance Strategists has an advertising relationship with some of the companies included on this website.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- The formula to calculate the annual depreciation is the remaining book value of the fixed asset recorded on the balance sheet divided by the useful life assumption.

- Get instant access to video lessons taught by experienced investment bankers.

- The General Depreciation System (GDS) is the most common method for calculating MACRS.

While more technical and complex, the waterfall approach seldom yields a substantially differing result compared to projecting Capex as a percentage of revenue and depreciation as a percentage of Capex. At the end of the day, the cumulative depreciation amount is the same, as is the timing of the actual cash outflow, but the difference lies in net income and EPS impact for reporting purposes. The recognition of depreciation is mandatory under the accrual accounting reporting standards established by U.S. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Management that routinely keeps book value consistently lower than market value might also be doing other types of manipulation over time to massage the company’s results. Suppose that the company changes salvage value from $10,000 to $17,000 after three years, but keeps the original 10-year lifetime. With a book value of $73,000, there is now only $56,000 left to depreciate over seven years, or $8,000 per year. That boosts income by $1,000 while making the balance sheet stronger by the same amount each year.

Depreciation is thus the decrease in the value of assets and the method used to reallocate, or „write down“ the cost of a tangible asset (such as equipment) over its useful life span. Businesses depreciate long-term assets for both accounting and tax purposes. The decrease in value of the asset affects the balance sheet of a business or entity, and the method of depreciating the asset, accounting-wise, affects the net income, and thus the income statement that they report. Generally, the cost is allocated as depreciation expense among the periods in which the asset is expected to be used. The declining balance method is a type of accelerated depreciation used to write off depreciation costs earlier in an asset’s life and to minimize tax exposure.

Because large losses are realized early, the tax benefit will be spread over a longer period. Depreciation what is the difference between is necessary for measuring a company’s net income in each accounting period. To demonstrate this, let’s assume that a retailer purchases a $70,000 truck on the first day of the current year, but the truck is expected to be used for seven years.

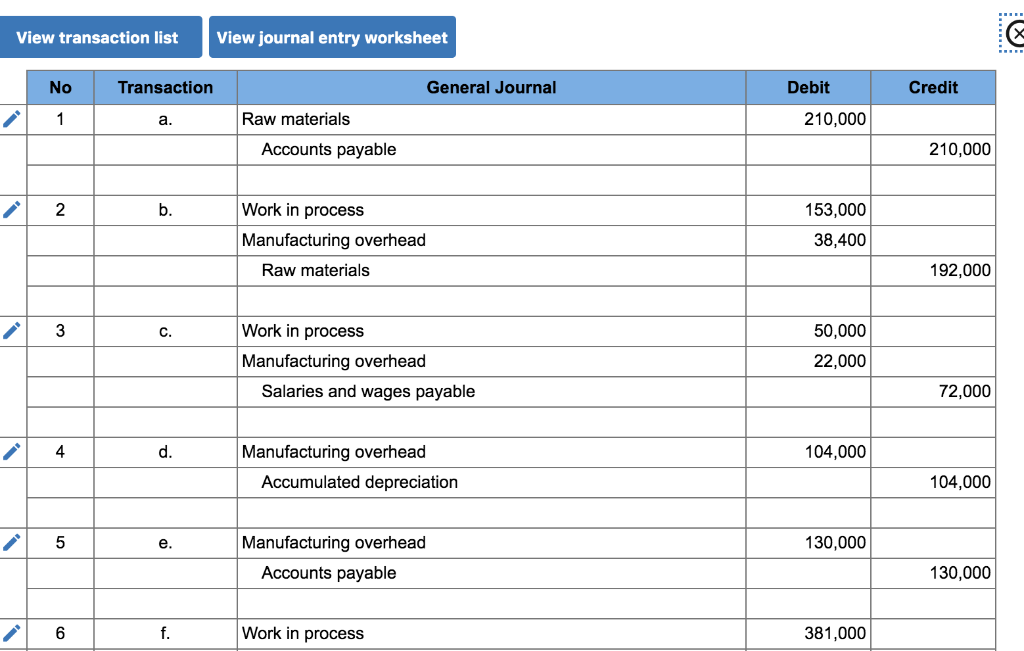

Journal Entry for Job Order Costing Example

The transactions are to be recorded for six jobs in production in August, Roberts’ first month of operations. The business applies overhead to the jobs on the basis of total direct labor cost. Examples includehome builders who design specific houses for each customer andaccumulate the costs separately for each job, and caterers whoaccumulate the costs of each banquet separately. Consulting, law,and public accounting firms use job costing to measure the costs ofserving each client. Motion pictures, printing, and otherindustries where unique jobs are produced use job costing.Hospitals also use job costing to determine the cost of eachpatient’s care. For example, in January, we used a total of $200,000 raw materials in production.

Video Illustration 2-3: Applying manufacturing overhead to jobs LO4

And these $200,000 raw materials include $20,000 indirect raw materials that cannot be traced to specific jobs. Non-manufacturing labor costs, such educator expense deduction as office or administrative wages, are period costs. Non-manufacturing labor costs are debited to an expense account for wages or salaries.

1 Job Order v. Process Costing

The diagram in Figure 8.1 shows a partial organizational chart for sign manufacturer Dinosaur Vinyl. The CEO has several direct reporting units—Financing, Production, Information Technology, Marketing, Human Resources, and Maintenance—each with a director responsible for several departments. A job cost system (job costing) accumulates costs incurred according to the individual jobs. Companies generally use job cost systems when they can identify separate products or when they produce goods to meet a customer’s particular needs. During this two-month period, one customer sent in an identical order each month, calling for the production of 1,000 units.

Manufacturing overhead

Production used $13,500 of direct material and worked 21 direct labor hours at a rate of $20 per hour. An organization-wide, or organizational, predetermined manufacturing overhead rate is computed by dividing the total estimated manufacturing overhead amount by the total estimated allocation base or cost driver. Total estimated overhead includes all product costs and is commonly separated into fixed manufacturing overhead and variable manufacturing overhead.

This required 400 direct labor hours at $1 per hour and materials amounting to $750. For example, we estimate the annual overhead cost and the annual direct labor cost to be $600,000 and $800,000 respectively for the period. And we have a total of $90,000 direct labor cost that occurred in January. This is because we usually need to make the journal entry for job order costing on a monthly basis. However, not all the cost information that is related to the manufacturing overhead is available on a monthly basis. Even if several jobs are started at once, it does not necessarily mean that they will all be completed at the same time.

Period costs are deducted from gross profit to arrive at net operating income, also referred to as net profit. In a journal entry, we will do entries for each letter labeled in the chart — where the arrow is pointing TO is our debit and where the arrow is coming FROM is our credit. Here is a video discussion of job cost journal entries and then we will do an example. Many companies use costing systems that are a blend of features of both job-order costing and process costing systems. Job order costing is a cost accounting system in which direct costs are traced and indirect costs are allocated to unique and distinct jobs instead of departments. It is appropriate for businesses that provide non-uniform customized products and services.

It should be noted that job costing and process costing are two different methods of costing. The overhead is then applied at this rate to each job based on its direct labor cost. The totals of all transfers in and out of the job cost sheets in the WIP ledger are also posted to the WIP control account in the general ledger. At the end of an accounting period the balance on the WIP control account should equal the sum of the balances on each of the job cost sheets in the WIP ledger. In a journal entry, we will do entries for eachletter labeled in the chart — where the arrow is pointing TO is ourdebit and where the arrow is coming FROM is our credit.

No matter who the customer is, they all end up receiving the same product. The nature of their work is such that they are interested in finding profitability of different jobs and hence they accumulate costs with reference to different jobs like audit engagement, consulting projects, books, movies, etc. Costs are transferred to the work in process account using the following accounting source documents.

He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. The company should use predetermined FOH rates for correct calculations and control.

- The accounting emphasis is in keeping records for the individual departments, which is useful for large batches or runs.

- Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

- When manufacturing overhead is applied to the jobs in process, it is credited from the Manufacturing Overhead account and debited to the Work In Process account.

- DS purchased raw materials (such as aluminum, fiber, etc.) at a cost of $4 million.

- Manufacturing overhead is applied based on labor hours in the fabrication department and machine hours in the finishing department.

Work in Process (WIP) is the inventory account where product costs including direct material, direct labor, and manufacturing overhead are accumulated while the jobs are in the manufacturing process. Work in Process (WIP) is the inventory account where product costs–direct material, direct labor, and manufacturing overhead–are accumulated while the jobs are in the manufacturing process. This means that the company would estimate $6 in manufacturing overhead costs for every one machine hour worked ($450,000 divided by 75,000 machine hours).

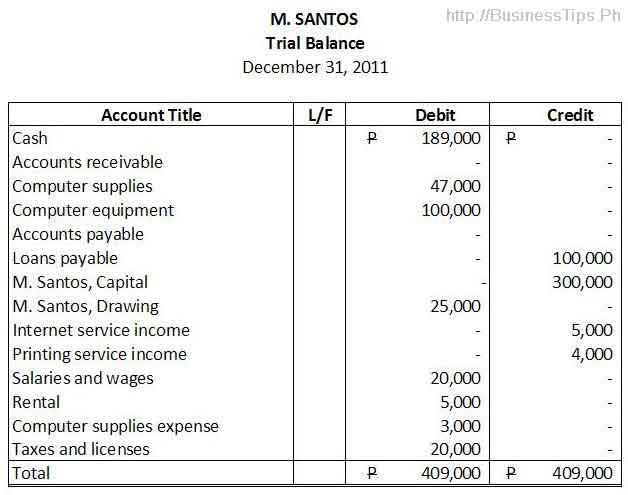

3 6 Prepare a Trial Balance Principles of Accounting, Volume 1: Financial Accounting

There are many different internal documents involved, whether you’re looking after your bookkeeping operations in house or outsourcing a professional accountant. Among these documents is the adjusted trial balance, and it is used to summarize all of the current balances available in the general ledger. Take a couple of minutes and fill in the income statement and balance sheet columns. Applying all of these adjusting entries turns your unadjusted trial balance into an adjusted trial balance. If the sum of the debit entries in a trial balance (in this case, $36,660) doesn’t equal the sum of the credits (also $36,660), that means there’s been an error in either the recording of the journal entries. The accounts that have been affected because of adjusting entries for the month of December are shown in red font in the adjusted trial balance.

Company

You could also take the unadjusted trial balance and simply add the adjustments to the accounts that have been changed. In many ways this is faster for smaller companies because very few accounts will need to be altered. An income statement shows the organization’s financialperformance for a given period of time. When preparing an incomestatement, revenues will always come before expenses in thepresentation. For Printing Plus, the following is its January 2019Income Statement.

5: Preparing an Adjusted Trial Balance

Once the posting is complete and the new balances have been calculated, we prepare the adjusted trial balance. As before, the adjusted trial balance is a listing of all accounts with the ending balances and in this case it would be adjusted balances. When it comes to running a business, finance is one of the most important – and often difficult – areas to understand.

Unit 4: Completion of the Accounting Cycle

In this case we added a debit of $4,665 to the income statement column. This means we must add a credit of $4,665 to the balance sheet column. Once we add the $4,665 to the credit side of the balance sheet column, the two columns equal $30,140. The statement of retained earnings (which is often a component of the statement of stockholders’ equity) shows how the equity (or value) of the organization has changed over a period of time. The statement of retained earnings is prepared second to determine the ending retained earnings balance for the period. The statement of retained earnings is prepared before the balance sheet because the ending retained earnings amount is a required element of the balance sheet.

- Both the debit and credit columns are calculated at the bottom of a trial balance.

- The adjustments need to be made in the trial balance for the above details.

- The following additional information is also to be incorporated into the above trial balance thereafter an adjusted trial balance is to be furnished.

- Examples of such transactions are depreciation, closing stock, accruals, deposits, etc.

After the unadjusted trial balance is prepared and it appears error-free, a company might look at its financial statements to get an idea of the company’s position before adjustments are made to certain accounts. A more complete picture of company position develops after adjustments occur, and an adjusted trial balance has been prepared. These next steps in the accounting cycle are covered in The Adjustment Process. An adjusted trial balance is formatted exactly like an unadjusted trial balance.

As with the unadjusted trial balance, transferring information from T-accounts to the adjusted trial balance requires consideration of the final balance in each account. If the final balance in the ledger account (T-account) is a debit balance, you will record the total in the left column of the trial balance. If the final balance in the ledger account (T-account) is a credit balance, you will record the total in the right column. solving resource capacity problems Service Revenue had a $9,500 credit balance in the trial balance column, and a $600 credit balance in the Adjustments column. To get the $10,100 credit balance in the adjusted trial balance column requires adding together both credits in the trial balance and adjustment columns (9,500 + 600). Once all accounts have balances in the adjusted trial balance columns, add the debits and credits to make sure they are equal.

At the end of an accounting period, the accounts of asset, expense, or loss should each have a debit balance, and the accounts of liability, equity, revenue, or gain should each have a credit balance. On a trial balance worksheet, all of the debit balances form the left column, and all of the credit balances form the right column, with the account titles placed to the far left of the two columns. The first method is similar to the preparation of an unadjusted trial balance. However, this time the ledger accounts are first updated and adjusted for the end-of-period adjusting entries, and then account balances are listed to prepare the adjusted trial balance. It is usually used by large companies where a lot of adjusting entries are prepared at the end of each accounting period.

The accounts of a Balance Sheet using IFRS mightappear as shown here. For example,IFRS-based financial statements are only required to report thecurrent period of information and the information for the priorperiod. After posting the above entries, the values of some of the items in the unadjusted trial balance will change. An adjusted trial balance is prepared after adjusting entries are made and posted to the ledger. In this lesson, we will discuss what an adjusted trial balance is and illustrate how it works.

The accumulated depreciation ($75) is taken away from the original cost of the equipment ($3,500) to show the book value of equipment ($3,425). The accounting equation is balanced, as shown on the balance sheet, because total assets equal $29,965 as do the total liabilities and stockholders’ equity. When it comes to the adjustment made, the adjusted trial balance sheet is left with information that is relevant for a particular period as per the information that the business organization seeks. The adjustments made, however, are classified into different categories, which include – deferrals, accruals, missing transactions, and tax adjustments. Once you have a completed, adjusted trial balance in front of you, creating the three major financial statements—the balance sheet, the cash flow statement and the income statement—is fairly straightforward.

The trial balance is at the heart of the accounting cycle—a multi-step process that takes in all of your business’ financial transactions, organizes them, and turns them into readable financial statements. If you’ve ever wondered how accountants turn your raw financial data into readable financial reports, the trial balance is how. To exemplify the procedure of preparing an adjusted trial balance, we shall take an unadjusted trial balance and convert the same into an adjusted trial balance by incorporating some adjusting entries into it. To simplify the procedure, we shall use the second method in our example.

Principle Business Activity Codes: List of IRS Business Codes Intuit

Attach a statement that identifies the line number of each amended item, the corrected amount or other treatment of the item, and an explanation of the reason(s) for each change. If the income, deductions, credits, or other information provided to any partner on Schedule K-1 or Schedule K-3, as applicable, is incorrect, file an amended Schedule K-1 or K-3 for that partner with the amended Form 1065. Also give a copy of the amended Schedule K-1 or K-3 to that partner. Check the “Amended K-1” or “Amended K-3” box at the top of the Schedule K-1 or K-3 to indicate that it’s an amended Schedule K-1 or K-3.

The uniform capitalization rules of section 263A generally require partnerships to capitalize certain costs incurred in connection with the following. For a special rule concerning the method of accounting for a farming partnership with a corporate partner and for other tax information on farms, see Pub. If the partnership has a cost of goods sold deduction, complete and attach Form 1125-A. Enter on Form 1065, page 1,line 2, the amount from Form 1125-A, line 8.

A joint undertaking merely to share expenses isn’t a partnership. what is a capital lease versus an operating lease Mere co-ownership of property that is maintained and leased or rented isn’t a partnership. However, if the co-owners provide services to the tenants, a partnership exists.

The Purpose of Form 1065

Regulations section 1.263A-1(e)(3) specifies other indirect costs that relate to production or resale activities that must be capitalized and those that may be currently deductible. Enter the applicable activity name and the code number from the list, Codes for Principal Business Activity and Principal Product or Service, near the end of these instructions. If a syndicate, pool, joint venture, or similar group files Form 1065, it must attach a copy of the agreement and all amendments to the return, unless a copy has previously been filed. The following services aren’t considered in determining whether personal services are significant.

Instructions for Form 1065 – Additional Material

QBI items and W-2 wages allocable to qualified payments include QBI items included on Statement A that are allocable to the qualified payments reported to the partnership on Form 1099-PATR from the cooperative. For purposes of determining the QBI or qualified PTP items, UBIA of qualified property, and the aggregate amount of qualified REIT dividends, fiscal year-end partnerships include all items from the tax (fiscal) year. Report the total section 743(b) adjustment net of any cost recovery as a single amount for all asset categories for each partner. In addition, attach a statement to the Schedule K-1 for this code showing the amount of each remaining section 743(b) basis, net of cost recovery by asset category. A reasonable grouping by asset category may be used, but such grouping shouldn’t be less detailed than the asset categories listed on the Form 1065, Schedule L, balance sheet. See IRS.gov/forms-pubs/clarifications-for-disregarded-entity-reporting-and-section-743b-reporting for more information.

- It requires meticulous preparation and a deep understanding of your business’s financial standing.

- As seasoned tax attorneys, we understand the challenges involved in navigating these forms.

- The purpose of Schedule M-2 is to inform the IRS of any changes to you or your partner’s capital accounts in the form of cash, property or any other capital contributions.

- However, in some instances, a partnership can elect to modify the section 481(a) adjustment period.

How to File Form 1065

Report gross income and other information relating to oil and gas well properties to partners to allow them to figure the depletion deduction for oil and gas well properties. Allocate to each partner a proportionate share of the adjusted basis of each partnership oil or gas property. This represents gain or loss on the sale, exchange, or other disposition of property for which a section 179 deduction has been passed through to partners. The partnership must provide all the following information related to such dispositions (see the instructions for page 1, line 6, earlier). Enter the total consideration received by the transferor partnership as a result of a transfer election under section 6418.

Getting Help with Form 1065 and Schedule K-1

If the return is for a fiscal year or a short tax year, fill in the tax year space at the top of each Schedule K-1. On each Schedule K-1, enter the information about the partnership and the partner in Parts I and II (items A through N). In Part III, enter the partner’s distributive share of each item of income, deduction, and credit and any other information the partner needs to file the partner’s tax return, including information needed to prepare state and local tax returns.

How to Run the Easy Step Interview in QuickBooks 2018

Contents:

Figure 1-7. Some bits of company information change more often than others. For instance, you might relocate your office or change your phone number, email address, or website address. But stuff like your company’s legal name and address, federal Employer Identification Number, and business type usually stays the same. In the “Open or Restore Company” dialog box, select the “Open a company file” option, and then click Next.

If you’ve used a previous version of QuickBooks, your company file is set up to work with that version. When you upgrade to QuickBooks 2016, the program has to make some changes to your company file. If you want to see more than one company, reset the number of entries again, this time to a higher number.

Money Out There is no such form in QuickBooks.c. Enter Credit Card Charges Credit card charges are considered credit card purchases.d. Write Checks or use check register This is the correct answer. Make sure that the bank account is a Petty Cash account that you set up .

In addition, you need complete reports of your past payrolls because Quicken payroll transactions don’t convert to QuickBooks. Screen asks whether you plan to write checks to pay bills immediately or enter bills in QuickBooks and then pay them later . You can read about bill preferences on Bills and payment preferences on Multiple Currencies.

Opening a Recently Opened Company File

And then, hit click on the option to create a new company on the no company open window. After that, opt for the option to create a new company in the no company open window. Even though it was not your fault, the bank will charge you a fee. You can record this when you find out about the NSF check. Or you can record it when you reconcile the checking account.d.

10, You can have 14,500. 1, You can have 14,500. 2, You can have 14,500. 14, This is the correct answer. You can have as many sg&a definition as you want in QuickBooks Enterprise Solutions.

Inventory Part You must track the quantity of Inventory Parts you buy. In this case, you don’t buy cupcakes. If you set up an inventory part called cupcakes, the inventory would always decrease but would never increase (because you don’t buy cupcakes). If you used Inventory Parts to track your purchases, you would always use the Items tab on purchase forms. Inventory Assembly Inventory Assemblies are used when you assemble an inventory item from other inventory items.

Opening a Portable Company File

Which of the following is NOT a backup option in QuickBooks? Manually back up the file. Automatically back up the data file when closing QuickBooks. Schedule an unattended backup d. All of the above are QuickBooks backup options.

- Our experts & certified professionals work with an aim to cater utmost satisfaction to our clients.

- On the Write Checks window, click the Items tab and enter the Payroll Items you are paying.

- When setting up a new company through the EasyStep Interview, some company information is optional and some is absolutely required.

- QuickBooks closes all windows.

- When you record your first bill, the program automatically adds a new account called Accounts Payable to your chart of accounts.

Also, the same feature is not available for QuickBooks online banking users due to the security and time-related data from the financial institution. Subsequently, select the company and financials and choose the balance sheet standard option. The first benefit is that the performance of the system will not be deteriorated due to large data files. And then, on the no company window, choose the option to create a new company. Next step is to hit a click on create company option.

To keep your entire financial history at your fingertips, you need to put every transaction and speck of financial information in your QuickBooks company file. Is where you store your company’s financial records in QuickBooks, so it’s the first thing you need to work on in the program. Choose ‘Next’ and a window will open for you to save your company file. The file name is pre-filled based on the information you entered in Your Company Information. You can change it to something else if you like. Choose ‘Save’ and Quickbooks will create the company file and save it for you.

& Payrolll for Your Small Business

Other products that Intuit would like to sell you appear at the bottom of the window. Click Update Now. QuickBooks first creates a backup copy of your company file, and then updates the company file. A progress bar shows how far it’s gotten.

- Passwords for other users can be set through the Company menu.

- There is less money in the checking account.

- Give a refund Choose this option, and QuickBooks opens the Write Checks window so you can issue a refund.c.

- All transactions during the specified date range To do this, you would select “Statement period from _ to _.” c.

- So that QuickBooks can enter the dates on the Payroll Calendar that checks are due.

- Create a sales order and then create an invoice when payment is due.

Then, if you need to create your company file yourself, you’ll learn how to use the QuickBooks Setup dialog box or the EasyStep Interview to get started . If you’re converting your records from another program, this chapter provides some hints for making the transition as smooth as possible. Finally, you’ll learn how to open a company file, update one to a new version of QuickBooks, and modify basic company information. Creating a QuickBooks desktop company file might seem to be a complex task for users.

It is always critical to safeguard financial information whether on paper or in a software program. Be sure to enter a strong password here and write it down before you go any further in the Quickbooks EasyStep Interview. You don’t want someone gaining unauthorized access to your books. The more complicated your password, the harder it is to memorize, so be sure to store it in a safe place away from your computer. Here, I will walk you through the interview step by step to explain how best to respond to the questions you will be asked.

It does not allow users to look at data after the period has closed. Sensitive data is safeguarded after the close date, since access is password protected. Yes. When you delete the vendor, a box appears asking if you are sure you want to delete.

The easiest way to open a recent file is to choose File→Open Previous Company, and then choose the file you want to open, as shown in Figure 1-6. If the Open Previous Company submenu doesn’t list the file you want, follow the steps in the next section instead. Screen is where you specify whether you want to use QuickBooks’ payroll and 1099 features. If you do, select Yes and turn on the appropriate checkbox.

You’ve just been hired by a bakery that sells delicious cup cakes. When they buyingredients , they use the Expense tab and assign thecosts to a Cost of Goods Sold account. You need to set up an item for cakes.

d. Select Import My Chart of Accounts during the EasyStep Interview.

What happens to the inventory asset account when you enter a purchase order forinventory? The inventory asset account increases. Purchase Orders are nonposting. This means they do not affect accounts at all. The inventory asset account decreases.

Windows’ taskbar keeps your favorite icons near at hand. The taskbar is easy to reach, because program windows don’t hide it the way they do desktop shortcuts. You can rename desktop icons, as was done here. To do that, right-click the icon, and then, on the shortcut menu, choose Rename. Type the label you want to use, and then press Enter.

F This does nothing in QuickBooks.d. Ctrl + 4 This does nothing in QuickBooks. To make the conversion proceed as smoothly as possible, some cleanup of your Quicken file is in order. For example, record overdue scheduled transactions and send online payments before you convert your Quicken file. Also, in Quicken, delete accounts you no longer need, because after they’re in QuickBooks, you can’t delete them if they contain any transactions. And make sure that customer names are consistent and unique.

How to Set Up Payroll for Small Business

For employees who have temporary work visas, pay attention to expiration dates, since employers are responsible for knowing when to update employment forms without official notice. Earlier in the article, we touched on the fact that one of the main tenets of managing payroll is also keeping records. To stay compliant (and to have a backup in the event any workers have questions), maintain all of your payroll transactions, including employee hours, wages, tax withholdings, and benefits. In some cases, you may need to have these documents available should your business be subject to an IRS audit. For more information on the different rules, we have a guide, plus some tips on how to keep it all organized. However, with some planning, you can manage this process yourself, hire an outside company, or hire a team to do it for you.

Keep up-to-date employee records

Set up and track employee paid time off and manage paid, unpaid, sick, and vacation time. Managing payroll covers a lot of territory, but here are the minimum main tenets that most employers have in place. You’ll also need to make sure that you have an employer identification number (EIN). The IRS issues the primary EIN and you can apply online for free. You will also most likely need a state tax number from the state’s tax assessor. Wave PayrollPlans start at $20 per month (base) and $6 per person per month.

- If you’ve received court orders for wage garnishments, consider using payroll software with garnishment management services to stay in compliance and avoid penalties.

- Employees can be paid based on a salary or hourly based on a time sheet.

- Part of getting management in place is getting a records system in place.

- If managing payroll becomes too complex, hiring a specialist can save you time and reduce the risk of errors.

- Some providers can also help make sure that important payroll forms, such as Form 941 which are filed each quarter, and Form 940 which is filed on time at the end of each year.

Our payroll software also includes same-day direct deposit and automatic tax filing, which is backed by tax penalty protection. They do all the heavy lifting with taxes and withholdings for a small fee. They pay the appropriate person, tax body or benefits program while all you need to do is tell them who gets paid for how many hours or what salary.

Stay up to date on state, local, and federal taxes

Then, stay on top of your payroll by regularly updating records and tracking employee hours so that when it comes time to run payroll it can be a smooth, accurate process. When it comes to general employee benefits, over half provide workers’ compensation insurance, followed by a third of SMBs offering a retirement savings plan. In larger companies, payroll is typically managed by the HR department or a dedicated payroll administrator.

Why use QuickBooks Online Payroll software?

Here are some ways that businesses handle this responsibility. Once again, we caught up with Billie Anne Grigg to share her thoughts on taking the DIY route for business owners that prefer to handle this task themselves. You will also need to keep in mind state tax deposit deadlines, although the good news is that most states follow the federal depositor guidelines. Kimberlee Leonard has 22 years of experience as a freelance writer. Her work has been featured on US News and World Report, Business.com and Fit Small Business.

Having a payroll management process in place is important to the success of a business because it goes beyond paying employees accurately and on time. Whether you choose to handle payroll yourself, hire a specialist, or use advanced software, having this portion of your business buttoned up will keep you informed, organized, and compliant. To manage this, you can sync up payroll, so that you pay premiums based on how many employees you have with pay-as-you-go workers’ compensation. When managing it all, the takeaway is that benefits and some required insurance should be something to think about.

Taxes done for you

When setting up payroll for your small business, you’ll find a lot of details come down to whatever payroll system you’ve chosen to implement. We’ll get more into those in a minute, but first, here are a few general steps for setting up payroll. The payroll process can vary for each business, but there are some core functions that need to be completed with each payroll run. We believe everyone should be able to loan account definition make financial decisions with confidence.

All QuickBooks Online Payroll plans offer full-service payroll. That means, in addition to automated payroll, you’ll receive full-service features. Applying for and obtaining an EIN is essential for reporting taxes and other documentation to the IRS. It’s something you are going to want to take care of before hiring employees. This ID number is putting an official stamp on your business venture.

An overview of What is Cloud Computing in Accounting?

Contents:

For $200 per year, users can have access to features like unlimited real-time reports such as profit and loss (P&L) statements, cash flow statements, balance sheets and transaction reports. Users can also create and send custom invoices, secure payments through WePay and provide accountants with access. The plan also comes with unlimited storage, unlimited access to personalized support at no additional cost and a mobile app to upload and match receipts to expenses in real time. They may even need to make capital purchases of new, expensive hardware, like servers.Overall, less maintenance is required for cloud accounting. Two parties simply need access permission to the same system with their respective passwords.Usually, traditional methods use flash drives to transport data, which could be stolen or lost. Kashoo is cloud accounting software for small business owners who want the simplicity of doing their own books.

A bank feed is the direct integration of your internet banking with your cloud accounting platform, allowing you to access all your banking data. Sage Business Cloud Accounting – Bigger businesses will like the scalable accounting of Sage’s cloud platform, with all the business functionality of their desktop version. Third-party apps are available, but extra Sage modules will add to your costs and budget.

Easy scalability to meet growing business demands

As a dedicated professional serving local business owners with a high quality and at the same time affordable bookkeeping service, the well being of all clients is the priority. Any data that can be stored on a computer can be stored in a cloud accounting application. Businesses can store anything from proposals and quotes to accounts payable and receivable files.

- While human error will always play some role in security breaches, you can be confident in your accounting platform when it comes to keeping your information safe.

- As your company grows it might be necessary to integrate multiple types of software to scale the business.

- Unauthorized transactions are minimized with paperless invoice processing and electronic payments.

- I accept that this website will save a copy of my enquiry via this form.

- We reviewed several cloud accounting software providers using a detailed methodology to help you find the eight best payroll services for small businesses.

Also, cloud accounting requires far less maintenance than its traditional counterpart. The cloud provider completes the backups, updates occur automatically and nothing needs to be downloaded or installed on a company computer. FinancialForce accelerates business growth with customer-centric ERP, Professional Services Automation , and Customer Success solutions. Run on the leading cloud platform, Salesforce, FinancialForce enables organizations to unlock customer insights, deliver innovative experiences, run a connected services business, and achieve agility and resilience. But today’s businesses also need a way to unify sellers with other key business functions, including professional services teams and traditionally back-office roles, such as accounting and finance. Shipping software is designed to manage and streamline your shipping processes, get yourself organized, save more on shipping, and increase customer satisfaction with timely deliveries and easy returns.

Easy access

AvidPay provides paperless payment management, while AvidInvoice streamlines the entire invoice process while matching current approval workflows. The robust finance and accounting functions of NetSuite ERP does not only ensure accurate bookkeeping but also ensure that your accounting methods are compliant with accounting standards. Compliance management is integrated with every functionality of this cloud accounting software. FreshBooks is a top cloud-based finance and accounting software that supports freelancers, self-employed professionals, businesses with employees, businesses with contractors, and other business types. The features and capabilities of FreshBooks are designed for both business owners and accountants. Any cloud-based system brings a range of advantages, such as ensuring authorized users can access up-to-date, accurate financial information from home or while traveling.

Key performance indicators are the main metrics you use to measure the performance of your classified balance sheet, and will be displayed in your accounting dashboard or business intelligence software. It offers a few third-party apps to connect to, but not at the same scale as Xero or QuickBooks. Lastly, cloud providers usually have backup servers in two or more locations. Should one server network go down, you still have access to your data.

Centralize revenue streams in a single revenue recognition and forecasting solution. Get compliant with the new ASC 606 and IFRS 15 standards, automate calculations, and reduce period-end close for a complete picture of your revenue. Create a single source of truth for even the most complex customer relationships while boosting accuracy and efficiency with the best subscription billing software for Salesforce. Web scraping, residential proxy, proxy manager, web unlocker, search engine crawler, and all you need to collect web data. If you’re a fan of keeping everything in one place, I believe you’re going to love Sage. They’ve won several awards over the years for their great service, so you’d definitely want to check it out.

Details on pricing are also included so you will have an idea of how much it would cost to deploy each particular solution. However, a key benefit of cloud accounting applications is that you can build upon your accounting software stack to better suit your business needs and improve the efficiency of your workflows. For instance, Hubdoc is an application that automatically fetches financial documents and extracts key data. When integrated with any of the platforms mentioned above, the value of both Hubdoc and your general ledger software increases.

These applications are natively integrated with a common user interface, and all information is unified on a single platform, eliminating the need to move between systems to manage different aspects of your business. And as a SaaS solution, NetSuite customers automatically receive new releases with key updates twice per year and don’t have to worry about hardware or maintenance. We prioritized software that was either low-cost or had an affordable plan in a series of pricing plans. We also gave credit to those apps that either provided users with a free version of the software or at least a free trial period. When considering the affordability of cloud accounting software, many providers have promotions going where the software is greatly reduced for a brief period, then goes up in price. Those that had price increases that were reasonable fared better in our ratings.

Is SAP cloud-based accounting?

Read our blog post to get ideas from leading accounting and bookkeeping professionals. The cloud has disrupted and transformed many industries over the past several years, allowing businesses to operate more efficiently, cut costs, and amplify results. In the simplest terms, cloud computing means storing and accessing data and programs over the Internet instead of your computer’s hard drive. Powerful yet simple accounting features for Cash Book entry, Journal entry, Knock Off entry, Bank Reconciliation and financial reports. Ideal for accounting service providers, convenient and efficient. The new guidance clarifies that implementation costs, including CCAs that do not transfer a software license, may qualify for capitalization based on the phase and nature of the costs.

You can easily import any CSV, TXT files and QuickBooks transactions and records. Accounting with live bookkeeping Organize books with a live bookkeeper. It’s easy to use with everything we need in running our global business more smoothly.

Resources for Your Growing Business

Patriot Software Accounting Premium is best for uncomplicated small businesses who probably won’t outgrow it. The integration with Patriot’s payroll application is a definite plus, but the accounting side lacks depth in areas like contact records, inventory, time tracking, and merchant account choice. Its price, voluminous support, and usability make it a great choice for a novice or a small startup. Patriot Software has a payroll application, which we’ve reviewed for years, and we wanted to see what the company’s integrated accounting counterpart was like. Uncomplicated navigation, an attractive, intuitive UI, and exceptional mobile access add to its appeal. It’s missing some features that competitors offer, and it includes some language and concepts that rivals keep in the background, but it’s a solid, inexpensive solution.

Rossum can extract data from a variety of document formats and layouts while the self-learning AI engine continually adapts based on your corrections. Rossum also matches your vendor, product, and PO lists through deep integration. The vendor wizards feature of Tipalti Approve puts all vendor information in one place. The vendor database gives you quick access to vendor information and updates you on contracts for renewal and renegotiation. With this information, you can start making informed decisions about the future of your accounting. Join us for an exclusive interview with Linda Wedul from the MNCPA!

Automatically sync your bank accounts so you don’t have to manually import transactions or verify expenses. If 84% of businesses using cloud software are cutting their application costs — it’s a good indicator that with the adoption of online accounting, you can too. While costs vary by vendor, SaaS solutions charge an annual license fee for access to their service. That license fee is usually based on a starting price, plus the number of users and products used. For example, a small products company may need only basic accounting software, while a subscription-based business with complex billing processes may require an add-on module to meet revenue recognition requirements.

Assessing cross-functional arrangementshttps://1investing.in/ for data migration and integration into other systems. Design a process to identify, evaluate and account for unsuccessful sprints. Addressing operational complexities that may arise from agile software developmentConsider challenges for a sprint vs storyboarding approach and the respective governance approach for each. Identify direct labor, incentive compensation, engineering costs, and meals and entertainment costs. Expert advice and resources for today’s accounting professionals.

Solving accounting and financial reporting challenges of Cloud migration or IT transformation

I am certain your accounting will get a whole lot easier by using these cloud-based solutions. You can organize a whole year’s worth of expenses in a jiffy with Kashoo. It has a “smart inbox” feature that separates personal and business data and helps you get ready for taxes. The most impressive thing is, their AI technology will learn your business and make manual expense tracking history so that you don’t have to do it. It helps in creating and controlling the budget, making major purchase decisions, and also track expenses. Without accounting, your business will always remain a little deficient when it comes to growth.

Its $70 per month Established plan comes with everything in the Growing plan, but also lets you track projects, use multiple currencies, claim expenses and view in-depth data analytics. Zoho Books is a good choice for small businesses that are already using Zoho products and services because it integrates well with other Zoho apps. It’s also a good fit for service-based businesses, such as consultants, landscapers and plumbers. This works a lot like the package deals vertical app markets currently offer, but with a more customized approach that allows the user to build a cloud-accounting solution specifically for their business. Have you ever wondered how much easier your business tasks might be if only you had a personal financial advisor?

Changing the game: how to build an advisory culture in your … – economia

Changing the game: how to build an advisory culture in your ….

Posted: Sat, 15 Apr 2023 06:33:09 GMT [source]

We looked at dozens of third-party user reviews to see if the providers live up to their marketing claims. This helped to gauge the quality of each product further and provide deeper insights into what each does well—and where they fall short. With MarginEdge, you’ll pay $300 per month per location for access to all its services. And while it doesn’t have a free trial, you can demo the product.

AvidXchange offers superior features such as paperless invoicing, PO automation, and B2B payment processing. The benefits of cloud computing are considerable, and recent accounting changes have made cloud solutions even more attractive to many businesses. On August 29, 2018, the FASB issued new guidance on a customer’s accounting for implementation, set-up and other upfront costs incurred in a cloud computing arrangement hosted by the vendor—that is, a service contract. Under the new guidance, a customer will apply the same criteria for capitalizing implementation costs of a CCA as it would for an on-premises software license. Accounting software is a computer program that helps businesses track income and expenses.

Accounting for marketing agencies: budgeting, KPIs and freeing up time for creativity

Implementing effective cash management strategies is essential for bookkeeping for marketing agencies a marketing agency’s day-to-day operations. One key strategy involves optimizing cash inflows and outflows to maintain adequate liquidity at all times. Accurate bookkeeping also plays a vital role in tax compliance for marketing agencies.

Offer Free Resources and Educational Tools

Assess the vendor’s track record in securing R&D tax credits and ask for client success stories in this specific area. A vendor well-versed in maximizing these credits can result in substantial financial benefits. Do you require basic bookkeeping services or comprehensive financial management?

Accounts payable

- But there’s one aspect of your business that’s often overlooked – bookkeeping.

- Otherwise you might be doing too much work for too little pay and not realize it.

- There are often significant cost savings to working with a third-party bookkeeper or accounting firm rather than bringing such professionals in-house.

- As you implement these insights, remember to prioritize accuracy and transparency in your financial records, as this will provide a solid foundation for informed decision-making.

- You’re part of an industry that’s dynamic, fast-paced, and always evolving.

- Moreover, it supports informed decision-making by providing insights into whether the agency can afford new hires, expansion initiatives, or additional marketing efforts.

Your accounting system should facilitate both the tracking of billable expenses and the invoicing of those expenses back to clients. Failing to bill back project expenses erodes project profitability and could create cash flow problems for your agency. Reviewing your financial statements each month can help you identify areas where you may be overspending or can cut costs. It can also help you make informed decisions about investments or other financial decisions for your marketing agency. The third step in setting up accounting for your marketing agency is to purchase an accounting software to use for your bookkeeping and accounting. By recognizing these differences and implementing effective financial strategies, you can confidently manage your marketing agency’s finances and set your business up for continued success.

Service

- Frequently closing out invoices (weekly, if possible) will thwart cash flow issues caused by non paying clients, since you can more quickly follow up on unpaid invoices.

- They may not have the budget, may not trust you yet, or may simply not be ready to commit.

- Freshbooks is popular with service-based businesses, including marketing agencies.

- Assuming your agency’s vendors don’t automatically collect payments, you’ll need to set up a recurring bill pay process in order to keep vendors happy and maintain an accurate accounts payable balance.

- One of the cardinal sins of accounting is commingling business funds with personal finances.

- Building these alliances broadens your opportunities and brings you closer to the pain points businesses are currently experiencing, helping you tailor your services.

For more information on how Sage uses and looks after your personal data and the data protection rights you have, please read our Privacy Policy. With Xero, you can even configure conditional logic and automated rules to automatically categorize many of these transactions. For example, you can create a rule to automatically categorize your monthly Slack fees in “software” category.

Contribute to discussions, offer advice, and share your knowledge on platforms like Reddit, Quora, and accounting-specific forums. This approach not only builds your reputation but can also drive traffic contra asset account to your website and attract potential clients. Videos are an engaging way to share information and connect with your audience. Create short videos that explain common accounting concepts, share client success stories, or introduce your team. For instance, a video explaining „How to Prepare for Tax Season“ can provide value to viewers while showcasing your expertise.

Reconcile bank & credit card accounts

We’ve already mentioned why it is a good idea to move away from spreadsheets and bank balance reporting and use dedicated cloud accounting software.Here are solid, affordable options for agencies. Running a marketing agency means managing a diverse team of creative professionals. Accounting comes into play when it’s time to create payslips and disburse salaries to your valued employees. Ensuring accuracy in salary pay stub is crucial for maintaining trust and transparency.

Annual financial statements help the marketing agency assess its profitability within a specific period. As a new digital marketing agency, your offerings may not be vast enough to justify a subscription-based model. But as you grow and build a loyal client base, offer recurring services to generate stable monthly revenues. Many https://www.facebook.com/BooksTimeInc accounting firms create detailed profiles of their target audience/clients, including the industry, business size, and specific needs. Knowing your audience helps you craft messages that resonate and address their pain points. To track expenses effectively, use software to automate the process and create categories that align with your business needs.