?5,100000 Financing Guide: How-to borrow 5,000 lbs now

Any type of the factor in credit, i’ve everything you need to obtain confidently inside our complete ?5,one hundred thousand mortgage publication.

Where ought i get a ?5,000 https://simplycashadvance.net/loans/tax-refund-emergency-loans/ mortgage?

Probably one of the most popular a method to use huge amounts of cash is through a personal bank loan . This involves researching money from a loan provider, the person you next pay from inside the typical instalments until the obligations, and people attention, are cleaned.

Personal loans come into many shapes and sizes, which could make it difficult to learn and that station was best for you. From the Versatility Funds, we allow simple to browse, by the examining your position and factors up against many loan providers, to understand the choices that could be best suited to you.

Am We eligible?

Become permitted obtain ?5,000, make an effort to meet the lender’s qualification criteria. The full band of conditions differ anywhere between company, however the most typical affairs generally speaking are:

- Your credit score otherwise credit history

- Your earnings

- Your debt to help you money proportion (the amount you currently pay for the debts)

- Mortgage objective (such as debt consolidating, otherwise to find a separate auto)

If you’d like to view whether you’re eligible to acquire, you can make use of all of our free qualification checker equipment to examine the information and browse compatible financing activities from your loan providers.

Must i acquire ?5,000 which have a less than perfect credit score?

Your credit rating are a statistic, according to your credit score, and this summarises your own reputation for credit. This permits loan providers to test if they are happy to financing extent expected on the loan application.

If your credit history is reduced, this may indicate that you really have before missed costs private financing or any other kinds of credit. As an alternative, you may have a small reputation for borrowing from the bank. While this isn’t a detrimental question, additionally doesn’t help to convince the lender you are reliable sufficient to become loaned big quantity. Regardless, the lowest credit rating might reduce count a loan provider is actually willing to part with, eg which have large sums such as for instance ?5,000.

While doing so, a high credit score was a definite signal that you are a dependable debtor. It will generally imply that you’ve got a recorded history of credible credit and you can payment with the-plan. Loan providers favor these cases, and they’ll be more comfy loaning out large amounts.

If for example the credit file is currently during the something off a rough patch, you don’t need to worry. Many loan providers remain willing to loan ?5,one hundred thousand with bad credit, not, they might implement a higher rate of interest otherwise promote a lesser matter.

Our very own financing eligibility examiner uses an excellent softer search, definition you could search appropriate mortgage choices predicated on their credit records, in place of affecting your credit score.

Can i affect acquire ?5,100 on the internet?

To begin with, just check out all of our eligibility examiner and get into a few very first info. The latest device will run a soft explore your credit statement and employ this to point compatible loan providers to meet your needs and you will circumstances.

On deciding on use ?5,100, the lending company will always manage an excellent hard credit assessment on the credit file and you may assess the application facing the eligibility conditions. It is vital to keep in mind that which tough credit check will appear in your credit report, so you should take the time to assess the choices and choose a loan provider.

In case your financial approves the job, they will after that follow-up with a binding agreement toward consumer loan that you will need remark, to test youre proud of the fresh new terms and conditions.

- The loan amount

- New cost name

- Any extra charge or fees that you will should be aware of

- Extent expected to be distributed at the end of the fresh payment identity

For those who have read through in detail consequently they are proud of the newest words, then you’re able to undertake the new arrangement and you will certainly be sent the newest requested loans.

Will i discovered my personal financing on the same day?

This is why you will commonly found your money towards same big date which you undertake the new arrangement. After its on your own membership, new ?5,one hundred thousand financing is your own personal to use freely as you designed.

Ought i manage to use ?5,000?

Whenever a lender approves your loan application and you can gift suggestions you that have a binding agreement, it can become a cost bundle, that have quantity might anticipate you to pay over a flat agenda.

It is critical to pay close attention to that it and look your capable pay the repayments into agreement’s full term. Shed a cost might have a terrible affect their borrowing score, so you should just agree to the borrowed funds when you are sure you might pay it back.

If the other expenses make you concerned about what you can do to help you pay back on the-day, then you might be interested in considering a debt negotiation loan . This will combine several expenses into you to definitely, that have a single, so much more in check month-to-month payment.

So what can I personally use my ?5,100 financing getting?

If investing your house, providing at the top of your finances otherwise financial support a primary existence enjoy, you might lookup finance readily available for well-known borrowing factors lower than:

How to pay the bucks I’ve borrowed?

After you’ve accepted the five,100 pound loan and also the loans were paid off in the account, you may be required to make concurred monthly repayments.

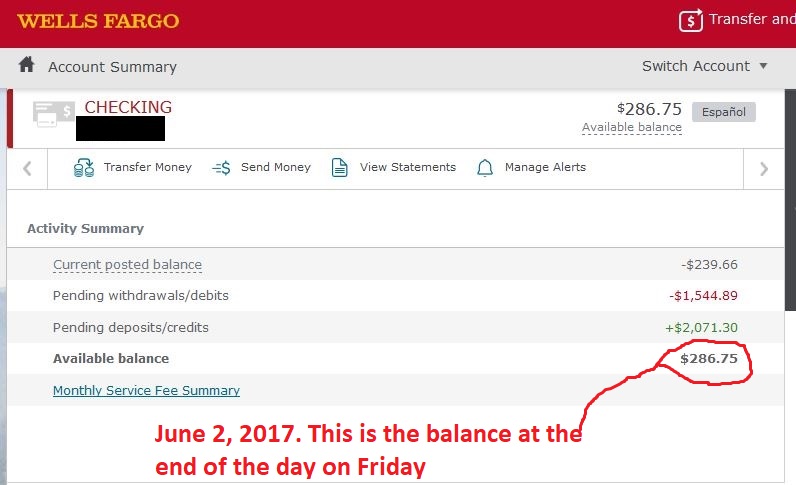

It could be helpful to place-right up an automatic lender transfer otherwise status buy after your pay check, to ensure that you result in the payments towards the-date. This can help to end accidentally forgetting a deadline, otherwise finding out you don’t are able to afford remaining for the your account to really make the percentage.

After you have paid your debt completely, together with people desire and extra charges or charge, you will want to get hold of your vendor to verify that your particular membership possess already been closed.

Check your qualifications and commence researching ?5,one hundred thousand finance

Are you ready to help you borrow ?5,one hundred thousand? Head over to our qualifications examiner observe how much you are in a position to acquire and acquire ideal financing to meet your needs.